Preparing for climate reporting: Insights from small ASX firms

The climate-related financial disclosures proposal follows on from the Corporate Sustainability Reporting Directive (CSRD) that was entered into force and introduced specific climate disclosure requirements throughout Europe. In the same year, the International Sustainability Standards Board issued IFRS S1 and S2 that are progressively endorsed by different countries around the world, including Australia.

In Australia, the proposed reporting period for climate-related financial disclosures would start as early as 1st January 2025 for companies meeting two of these three criteria:

- consolidated revenue ≥ $500 million;

- consolidated gross assets ≥ $1 billion; or

- number of employees ≥ 500.

This led our Mazars experts to investigate how prepared these companies are to report according to the proposed Australian climate-related financial disclosure standards.

Our research is based on the 2023 reporting (up to 10 January 2024) of 52 Australian Securities Exchange (ASX) listed companies with a market capitalisation between $1 billion and $1.5 billion.

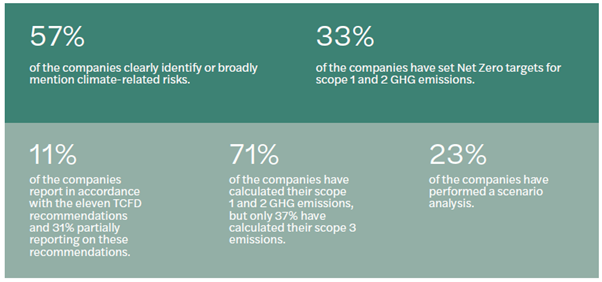

Key findings

The introduction of mandatory climate-related information disclosures in Australia will require many companies to step up their efforts. Importantly, companies need to:

- Build up climate capabilities and educate board members.

- Identify gaps and develop a roadmap.

- Involve key employees across multiple functions and clearly define responsibilities

Table of Contents

- Introduction

- Climate change, a growing risk for Australian companies

- Focus on the proposed mandatory climate-related financial disclosure standard

- Global regulatory landscape

- Australian regulatory landscape

- The Australian Sustainability Reporting Standards (ASRS)

- So, what’s next?

- Findings

- How many companies mention “climate-related risks” in their reporting?

- How many companies report according to the TCFD recommendations?

- How companies report on their carbon emission?

- How companies report on their emission reduction targets and decarbonisation pathways?

- How do companies use scenario analysis and report their climate-related risks and opportunities?

- How do companies report their sustainability information?

- Key considerations for climate reporting

Drawing on insights from the interpretive report “Achieving Effective Internal Control Over Sustainability Reporting” (ICSR) issued by the COSO and the findings of our research, we present a set of 28 key considerations to help companies prepare their climate reporting.

Download our full report below to learn how small ASX listed companies have made progress in their climate reporting in Australia.

Authors: Damien Lambert & Corentin Cachard

Published: 13/05/2024